Home sales jumped 7.2% between June and July, the largest increase in over a decade with the fastest pace in nearly two years. However, according to the National Association of Realtors(NAR). Prices are down 15% compared to last year.

The banks along with the government moratorium on foreclosures have fostered a sellers market to slow and stop the devaluation of home prices. A combination of distressed properties, seasonal trends, low interest rates, and tax credits for first-time buyers is working its magic. Several issues have me worried that instead of an end to this housing nightmare, we are about to be hit by another wave of foreclosure.

With a large percentage of sales focused on foreclosures, short-sales, or other forced transactions rooted in financial distress, our current buying trends are by no means normal. It's no wonder, with the Mortgage Bankers Association (MBA) reporting that more than one in eight mortgage holders are in some stage of delinquency or foreclosure. http://www.mortgagebankers.org/NewsandMedia/PressCenter/68008.htm

In July foreclosures jumped 7% compared to June. With subprime borrowers unable to refinance loans and prime borrowers unable to pay their bills because of job loss we will see default numbers continue to rise. According to the MBA survey, 58% of new foreclosure starts originated in the well-to-do prime loan category, up from 44% last year. Meanwhile, subprime borrowers were responsible for only 33% of foreclosures, down from 49% last year. As foreclosures affect a larger and larger swath of the population, it will only add to the number of properties on the market and prices will naturally gravitate lower.

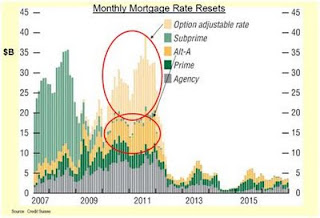

The major problem were facing now is the wave of loan resets in 2010 and 2011. As you can see in the chart below, a large number of prime, Alt-A, and Option ARM borrowers will be facing a higher payment, due to a mortgage rate reset, just as the housing market digests the fallout from the subprime problem of 2007 and 2008. Notice the reset activity for 2009. Should the economy actually start recovering, the Federal Reserve will have no choice but to raise interest rates during this period.

We also have an inventory issue. Despite a spike in sales, the inventory of existing homes for sale actually increased 7.3% to 4.1 million last month nationally. Here in Santa Clarita, California our inventory is at historically low levels, however with the foreclosure moratorium being lifted and homeowners attempting to short sell we could see a wave of properties hit the market by late fall.

Whats alarming to me is what Zillow found in it's latest survey. Zillow found that a full 81% of homeowners believe their homes value wont fall in value over the next six months. Adding to the perception that people are losing touch with reality, only 60% believed the value of their home had fallen over the last year; when in reality 83% of all homes actually lost value during that time.

My wife Jennifer and I are here to help homeowners who are dealing with foreclosure. After serving in the Military and Law Enforcement we pride ourselves in doing the right thing for those in need. Now is not the time to gamble with your financial future, you need a Certified Pre Foreclosure Specialist who understands this market and has the experience to get the job done. Call for your free consultation. 661-290-3837 We offer & extend our expertise from Santa Clarita to Oxnard through Thousand Oaks and the San Fernando Valley.