I find it hard to believe some Realtors are still trying to bypass educating themselves fully in pre foreclosure process. Utilizing third party negotiators to negotiate pre foreclosure's can be a benefit; however the Realtor has the fiduciary duty to ensure the negotiator is licensed and skilled at negotiating the "most favorable outcome". In order to properly screen individuals or companies claiming to be third party negotiators, the Realtor has to have the knowledge first. The Realtor who sits across the table from the clients armed with this knowledge is the key. As a result of bypassing their own education, or resisting the education, untrained Realtors utilizing negotiators only focused on short sale negotiations, continue to pass along incorrect information to homeowners, information which could cause the homeowner not to have the "most favorable outcome".

It's imperative that Realtors possess the correct information when having intelligent conversations with clients. Trained Realtors can point out facts without giving legal or tax advice to homeowners on the possible Tax & Deficiency issues. California is one of 12 states with Anti-Deficiency Laws. In some cases going through a foreclosure is the most favorable outcome because of the protections provided by the Anti-Deficiency Laws. Realtors need to know the difference. Realtors with a Pre Foreclosure Specialists Certification can point out the facts and explain non-recourse & recourse issues as they relate to; purchase money loans with PMI or LPMI, 80/20 non recourse splits involving 100% financing, or a 1st lien with a 2ndlien recourse Home Equity Line of Credit, (HELOC).

When choosing a Realtor to handle your pre foreclosure transaction, the Realtor must demonstrate their working knowledge of the guidelines the servicers and each note holder (investor) are working off of. Understanding how all the Government Programs, like the "Making Homes Affordable Program", the "Helping Families Save Homes Act" or President Obama's Foreclosure Alternative Program, ("FAP" Program) is setting the stage to streamline homeowner assistance. Most of these programs are requiring the servicer to attempt a loan modification; however the homeowner has to meet debt to income (DTI) ratios in order to qualify, if not the struggling homeowner can then proceed with a short sale, deed in lieu and lastly a foreclosure.

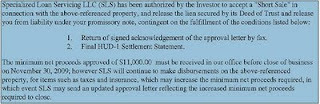

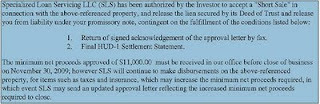

The Realtor must also be able to understand and point out the language used in approval letters, in order to guide the homeowner's conversation with their legal counsel. The terms "release" and "satisfy" should be scrutinized. Here is an actual example from a short sale approval I recently negotiated. The approval language used by SLS to "Release the lien secured by its Deed of Trust and "Release" the seller from liability under their promissory note was for a recourse 2nd lien, where the homeowner used a HELOC to pull out money out.

As you can see I was able to negotiate with SLS on the 2nd Lien (Recourse HELOC) and its investors to release the lien and release the seller from liability. This is very favorable language for the seller, who verified this with their counsel prior to moving forward and closing the short sale. These transactions must be negotiated and documented by a highly trained Realtor, a Realtor doing short sales with a purpose, not by default because these type of transactions are a majority of current real estate market.

Realtors who don't understand the foreclosure process or negotiating with loss mitigators are more likely to have 2nd liens "charged off". A "Charge Off" is an instance in which a consumer (homeowner) is seriously delinquent in paying a bill and the creditor elects to transfer the account to an accounting category such as "charged to loss" or "bad debt." In such cases, the creditor may also turn the account over to an in-house or third party collections agency. These cause problems and delays and may be a deal breaker when negotiating short sales, however a trained Realtor has the knowledge to deal with this situations.

Here are just a few questions to ask your Real Estate Agent before hiring them.

•· Can my real estate agent explain the short sale process?

•· Does my real estate agent have prior short sale experience & success this year?

•· How do I know if my property qualifies for a short sale?

•· Does my real estate agent know what "hardships" quality for a short sale?

•· Does my real estate agent have an effective short sale strategy?

•· Does my real estate agent know how to effectively Price & Market my property correctly?

•· Which is better- a foreclosure or short sale?

•· What are the consequences of the short sale?

•· Why would the servicer and investor agree to a short sale?

•· How is a short sale different from a normal sale?

Now is not the time to gamble with your financial future, there are lots of real estate agents claiming to be short sale experts. If your serious about finding solutions to minimize your financial loss and limit the damage to your credit history, contact Jennifer and Gary Ricco at Keller Williams VIP Properties. 661-290-3837 or through our website

http://www.santaclaritavalleyhomesonline.com/contact.htm.